Getting to Know Your Local Taxes

After tax season, the City often receives inquiries and questions regarding taxes – whether it be property, utility, sales, or income tax. The City of Maryland Heights is NOT involved in the assessment, billing, or collection of property, income, or other state and federal taxes. However, here are a few answers to the common tax questions we receive:

After tax season, the City often receives inquiries and questions regarding taxes – whether it be property, utility, sales, or income tax. The City of Maryland Heights is NOT involved in the assessment, billing, or collection of property, income, or other state and federal taxes. However, here are a few answers to the common tax questions we receive:If I own property in the City, how much of my taxes go to the City government?

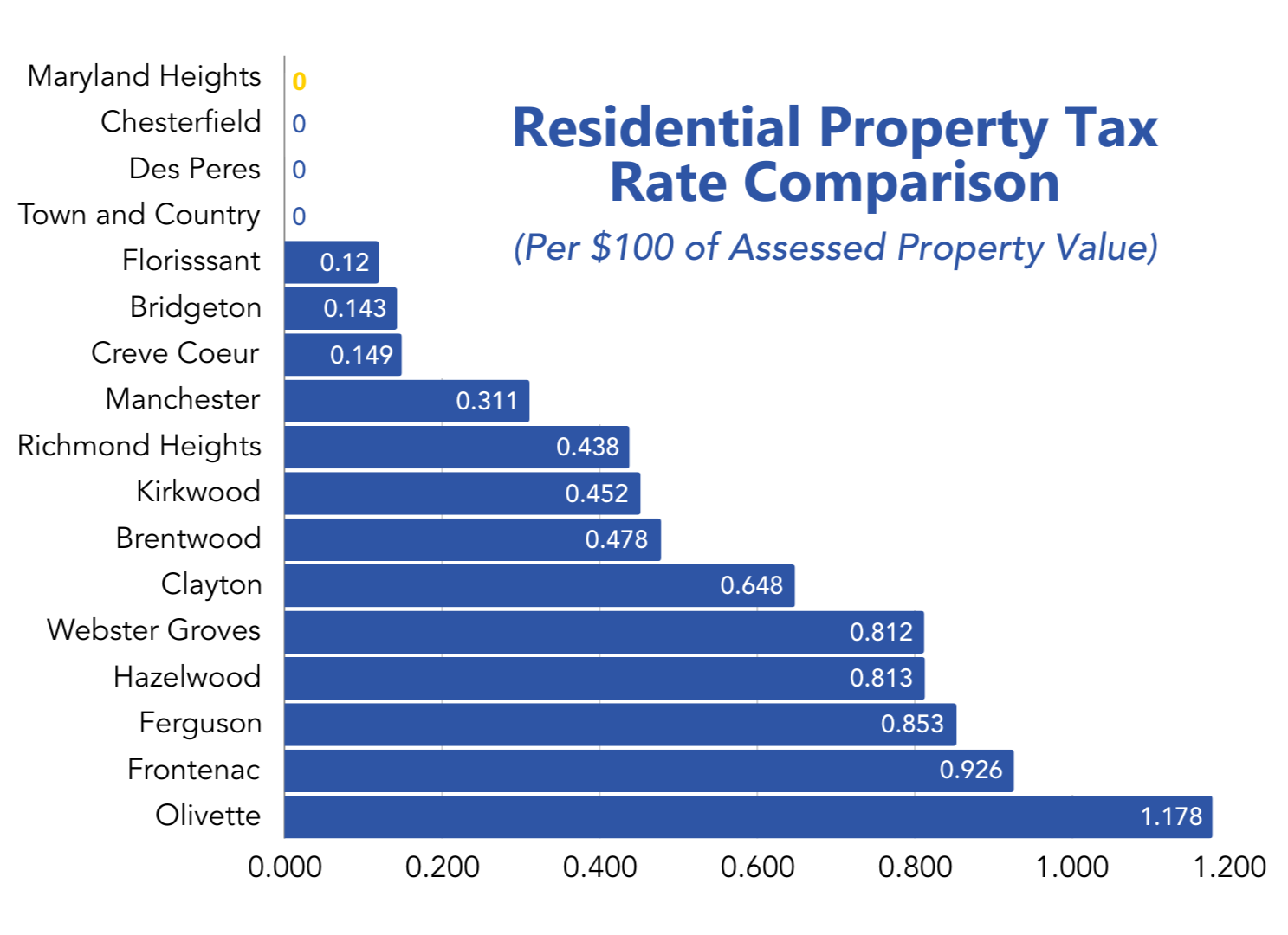

Unlike several other cities (see graph below), Maryland Heights does not have a property tax. The City of Maryland Heights does not collect any property tax from residents or businesses for real estate or personal property.

If my property tax dollars don't support City provided services, what services do they fund?

On your property tax bill, every taxing jurisdiction is listed and includes special districts servicing the area such as schools, fire protection, sewer, community colleges, and libraries.

How are tax rates determined?

Although some limitations are defined by state statute, the local taxing districts set the tax rates. Generally, tax increases must be approved by voters within the district.

- Copy.jpg) What is the sales tax rate and what services does it fund?

What is the sales tax rate and what services does it fund?The City receives revenues from three different sales tax sources - a county-wide one percent tax on retail sales that is distributed by municipality population, a half-cent municipal tax on retail sales that can only be used to fund storm-water control and/or parks services, and a half-cent public safety sales tax. The State and St. Louis County levies sales taxes to fund a variety of services. Currently, our sales tax rate is 8.24% except in special tax districts.*

How is the Maryland Heights Parks/Storm-water Sales Tax distributed?

Since 2015, all of this revenue has been distributed to the Parks Fund to fund recreation projects including the Community Center, recreation programming, trail expansion, Fee Fee Ballfields, Aquaport improvements, and the Sustainability Campus. Storm-water projects are funded from the Capital Improvement Fund, which the Parks/Storm-water Sales Tax is also allocated to.

What is the City's largest revenue source?

Gaming tax is Maryland Height's largest revenue source. The City receives a tax of $1 per casino admission and 2.1 percent of the net gaming receipts of casino operations at Hollywood Casino. The collection of taxes and disbursement to the City is administered by the State. Gaming tax revenues are deposited into the General Fund and Capital Improvement Fund where they cover expenditures including trash/recycling/yardwaste collection (free to residents), road improvement projects, and general operations.

If you have any questions about local taxes, please contact the City by email at mhlife@marylandheights.com or call

(314) 291-6550.